franchise tax bd refund

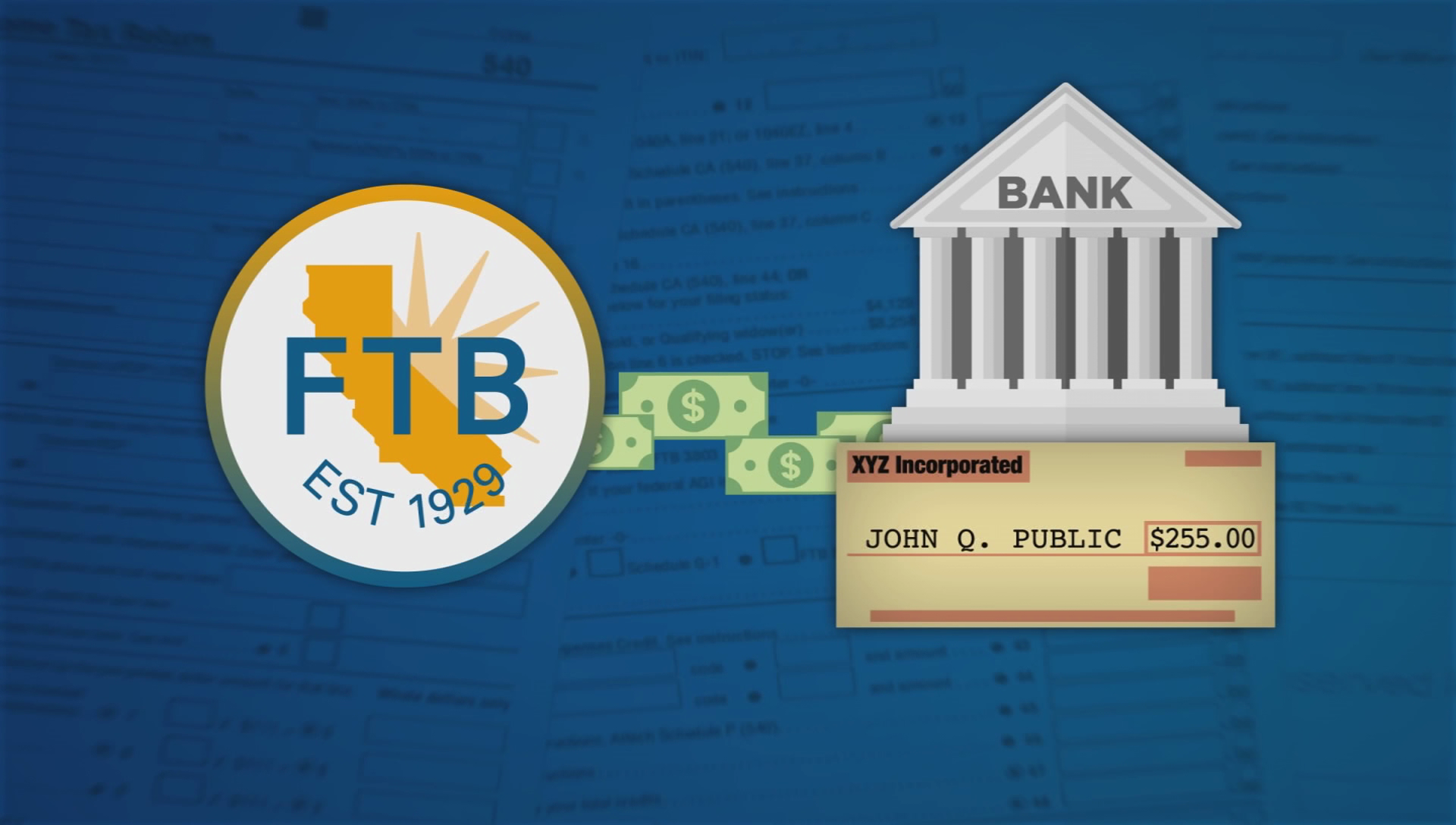

You can check the status of your California State tax refund online at the California Franchise Tax Board website. The deposit stands for Franchise Tax Board California State Tax Refund.

Extra processing time may be necessary.

. Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud and identity theft. Obtaining taxpayer account information is the privilege of individual taxpayers or their authorized representatives. 1996 51 CalApp4th 1180 1189 59 CalRptr2d 602 II.

The FTBs Notice of Proposed Assessment Was Invalidly Issued. If you received a refund amount different than the amount on your tax return well mail you a letter. The deposit stands for Franchise Tax Board California State Tax Refund.

Log in to your MyFTB account. The Franchise Tax Board board appeals from a judgment partially refunding corporate franchise taxes penalties and interest paid by Roy Chen. I have a traffic ticket which I extended the court date 3 months later.

Click below to check the status of your California State tax refund. This also happened to me. If the Franchise Tax Board fails to mail notice of action on any refund claim within six months after the claim was filed the taxpayer may prior to mailing of notice of action on the refund claim consider the claim disallowed and bring an action against the Franchise Tax Board on the grounds set forth in the claim for the recovery of.

I received a deposit from franchise tax board not matching what my tax return said do I receive my tax return in amounts. You will need to know the primary Social Security Number complete mailing address and the exact amount of your anticipated refund. How long it normally takes to receive a refund.

The Trial Court Properly Relied on Analogous Federal Authority to Require Resort to the Tax Return in Computing a Deficiency. File a return make a payment or check your refund. Follow the links to popular topics online services.

Section 19385 provides in relevant part. Unauthorized access to account information is unlawful as described in Section 502 of the California Penal Code. It says FRANCHISE TAX BD DESCASTTAXRFD which google slething tells me is a CA state tax refund.

Amended report write AMENDED REFUND at the top of each page if the amendment results in an overpayment. Franchise Tax Bd. Franchise Tax Refunds All taxpayers must provide the following information when requesting a refund of taxes paid in error directly from the Comptrollers office.

Up to 3 weeks. 540 2EZ line 32. View solution in original post 2 Reply 7 Replies AnthonyC Level 7 June 5 2019 616 PM That would be your California refund only.

I remember filing my tax return for 2015 and I had paid right on the money to CA I think I was owed a dollar or two back so there is no way this money is from that year. Up to 3 months. Wait for that letter before you.

CA State Tax Refund Status. Refund amount claimed on your 2021 California tax return. This would NOT include your Federal refund which will come separately.

California Franchise Tax Board.

Here S Your Estimated 2022 Tax Refund Schedule

Here S Your Estimated 2022 Tax Refund Schedule

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento

How To Redeem California Tax Income Return Warrants Personal Finance Money Stack Exchange

How Americans Spend Their Tax Refund Tax Refund Credit Card Infographic Tax Day

Where S My Tax Refund E File Com

Redbird Statement Credit After Depositing Federal Tax Refund

Download The Irs2go Mobile App For Income Tax Refunds Mobile App Tax Help Tax Refund

Can My Tax Refund Be Taken By The California Franchise Tax Board Ftb To Pay Off Debt

California Ca 2021 2022 Tax Considerations Refund Status Payment Delays And Stimulus Checks Aving To Invest

Receipts Seoul Tax Refund Tax Refund Seoul Refund

California Franchise Tax Board Taking Tax Refunds With No Notice Cbs Sacramento